Simple budgeting tips

Managing money can feel overwhelming, especially with the rising costs of living and constant financial demands. However, budgeting doesn’t have to be complicated. With a few simple strategies, anyone can take control of their finances, reduce stress, and save for future goals. Here are some straightforward tips to help you start budgeting effectively.

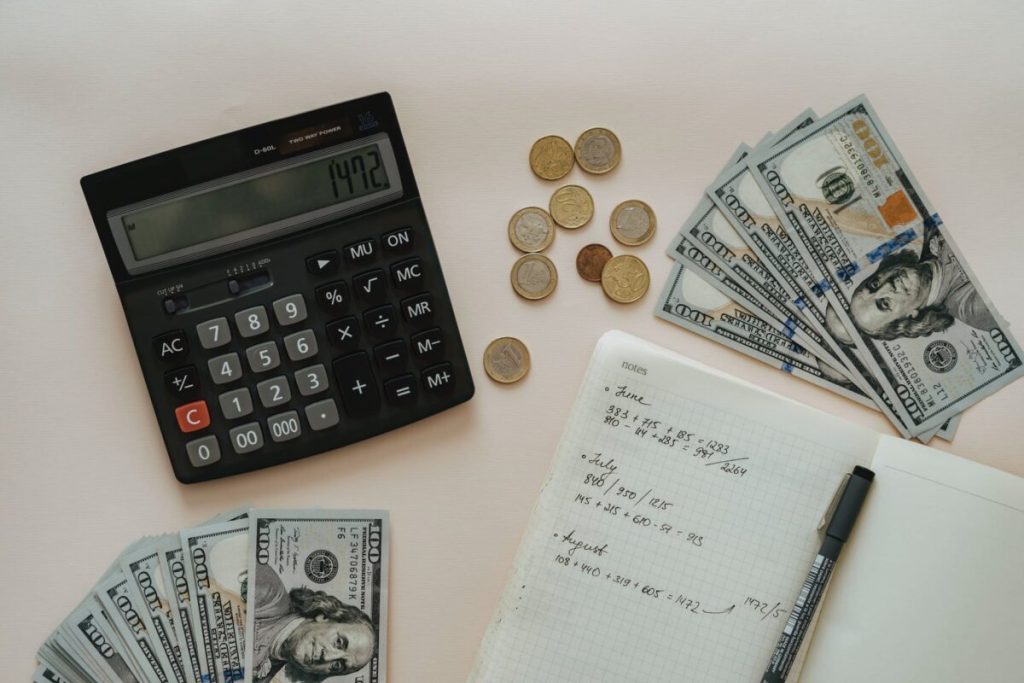

1. Track Your Income and Expenses

The first step to budgeting is understanding where your money comes from and where it goes. Start by listing all sources of income, such as your salary, freelance work, or side hustles. Next, track your monthly expenses. Include everything, from rent or mortgage payments to small daily purchases like coffee. By tracking your spending, you’ll identify patterns and areas where you might be overspending.

2. Set Clear Financial Goals

Budgeting is easier when you have specific goals. Do you want to save for a vacation, pay off debt, or build an emergency fund? Setting clear financial goals helps you prioritize your spending and stay motivated. Break larger goals into smaller, achievable steps. For example, if you want to save $1,200 in a year, plan to set aside $100 each month.

3. Use the 50/30/20 Rule

One of the simplest budgeting strategies is the 50/30/20 rule. This method divides your income into three categories:

- 50% for necessities: Rent, utilities, groceries, transportation.

- 30% for wants: Dining out, entertainment, hobbies.

- 20% for savings or debt repayment: Emergency fund, investments, paying off loans.

This rule helps you balance spending and saving without feeling deprived. Adjust percentages if necessary based on your financial situation, but it’s a good starting framework for beginners.

4. Plan for Irregular Expenses

Some expenses don’t happen monthly, like car maintenance, annual insurance, or holiday gifts. Failing to plan for these can disrupt your budget. Set aside a small amount each month for irregular costs so you’re prepared when they arise. This simple step prevents stress and avoids last-minute financial scrambling.

5. Cut Unnecessary Expenses

Once you track your spending, identify areas where you can cut back. Do you subscribe to streaming services you rarely use? Are you dining out more than necessary? Small reductions in unnecessary spending can add up over time. Even simple changes, like making coffee at home or packing lunch, can save a significant amount over the year.

6. Use Budgeting Tools

Technology makes budgeting much easier. Numerous apps and online tools can track your spending automatically, categorize expenses, and even send reminders for bills. Popular apps include Mint, YNAB (You Need A Budget), and PocketGuard. Using these tools saves time, reduces errors, and helps you stay accountable to your budget.

7. Pay Yourself First

A key tip for successful budgeting is to prioritize saving. Treat your savings like a non-negotiable expense. When you receive your paycheck, set aside a portion for savings before spending on anything else. This “pay yourself first” strategy ensures you build your financial safety net consistently.

8. Review and Adjust Your Budget Regularly

A budget isn’t a one-time setup. Life changes, and your budget should reflect that. Review your spending monthly and adjust as needed. Did unexpected expenses come up? Did you overspend in a category? Regularly checking your budget allows you to make informed adjustments and stay on track.

9. Build an Emergency Fund

Life is unpredictable, and emergencies happen. An emergency fund provides a financial cushion and prevents you from going into debt during unexpected situations, like car repairs, medical bills, or sudden job loss. Aim to save at least three to six months’ worth of living expenses gradually. Even starting with a small fund is better than none.

10. Stay Consistent and Patient

Budgeting is a skill, not an instant fix. It takes time to develop habits and see results. Consistency is key. Stick to your plan, celebrate small successes, and learn from mistakes. Over time, these simple budgeting habits will give you greater financial control, reduce stress, and open opportunities for saving and investing.

Conclusion

Budgeting doesn’t need to be complicated or stressful. By tracking your spending, setting clear goals, cutting unnecessary costs, and using helpful tools, you can create a manageable budget that works for your life. Remember, the goal isn’t perfection—it’s awareness and control. Start small, stay consistent, and watch your financial confidence grow.